Finances are the backbone of every organization, including yours. While businesses may have diverse purposes, such as supporting causes, building communities, or delivering services, the ultimate goal often revolves around financial health.

Success is ultimately measured by profitability, minimizing losses, and maintaining sustainability.

Good financial health and effective processes go hand in hand with the right finance management software. The more you utilize modern tools and features, the smoother and more streamlined your operations will be.

Issues like pending invoices, outstanding receivables, accounts payable backlogs, delayed P&L reports, and overdue dues can all be efficiently managed with the right system in place.

If you’re struggling with your current financial management setup or are searching for advanced options, this blog is just for you. Stay and gain valuable insights to transform your financial processes.

Challenges with Traditional Financial Processes

Before updating or investing in upgraded software or tools, it’s important to confirm whether this step is right for your organization.

To determine this, start by identifying if you are experiencing any of the following challenges:

Time-Consuming Manual Tasks

One big challenge is time-consuming manual tasks. If your team spends hours on activities that could be completed in minutes using advanced tools, consider an upgrade. A survey revealed that 38% of finance teams spend over 25% of their time on manual tasks, with larger teams reporting even higher percentages.

For example, manually entering invoice data, verifying payments, and reconciling accounts can take up hours every week. Saving this time allows you and your team to focus on other important priorities, such as finding new ways to improve your association.

An advanced finance management solution can automate processes like tracking and reconciling invoices, improving accuracy and allowing your team to work on more strategic initiatives.

Higher Risk of Errors

If your team often finds recurring mistakes in invoices or reports during the final review or rechecking stage, some errors may likely have gone unnoticed. This indicates that your financial records could be at a higher risk of inaccuracies.

Statistics show that humans make 100x more data entry errors than automated systems. A simple typo in an invoice amount or a miscalculated tax entry could lead to incorrect reports, delayed payments, or financial penalties.

These issues can result in financial discrepancies and harm your organization’s reputation.

This is a universal challenge but one that can be easily avoided. To address these risks, adopting efficient and reliable tools is crucial for maintaining accuracy and keeping your finances error-free.

Lack of Real-Time Insights

The lack of real-time data makes critical insights slip through the cracks. Your organization risks making decisions based on outdated or incomplete information, which can lead to significant consequences.

For example, a delayed invoice may go unnoticed without real-time updates. This oversight could result in late payments and damaged relationships with key stakeholders. Outdated financial reports may also lead to poor budget planning or missed funding opportunities.

Advanced tools deliver live insights and automate workflows. These solutions keep your organization on track, allowing decisions to be based on the most accurate and up-to-date information.

Benefits of Adopting Advanced Financial Tools

Once you’ve determined whether your organization needs to upgrade to advanced financial tools, the next step is to explore their benefits and understand what they can offer.

Here’s what you can expect with these tools:

Streamlined Operations

Advanced financial tools simplify your financial processes, removing the need for repetitive manual tasks like invoicing, payment tracking, and report generation. By centralizing data and integrating systems, they create smoother workflows and reduce inefficiencies.

For example, if your organization manages member dues manually, your team likely spends hours updating spreadsheets, reconciling payments, and following up on overdue invoices.

These tools automate key tasks, send reminders, and track payments in real-time. This accelerates operations and reduces the likelihood of errors.

With automation, your team can complete financial tasks 85x faster, allowing more focus on strategic priorities. Many organizations see a return on investment within 6-12 months, making these tools a smart choice for both short- and long-term gains.

Reduced Errors and Improved Accuracy

Proficient finance management solutions drastically reduce the risk of errors that are common in manual processes. Tasks such as data entry, invoicing, and payment tracking often result in human mistakes, such as typos or miscalculations, which can lead to inaccurate reports or missed payments.

Automating these processes guarantees precise calculations, consistent records, and minimized errors. Financial automation, in fact, reduces reporting errors by 90%, offering a significant boost in accuracy and reliability for your organization.

Fewer errors mean fewer corrections, which saves valuable time for your team while maintaining the integrity of your financial data. This heightened level of accuracy builds trust with stakeholders and empowers your organization to make better, more informed decisions.

Enhanced Member Experience

Reliable finance management software improves your members' experience with features such as automated invoicing, real-time payment tracking, customizable payment plans, and detailed transaction reports.

Your members benefit from a hassle-free process that reduces delays and errors.

Imagine a member trying to renew their subscription. Instead of dealing with manual billing and invoices, they receive automated reminders, can pay with one tap, and get immediate receipts upon payment.

This level of convenience not only saves time but also leaves a positive impression of your organization’s professionalism.

Moreover, access to real-time data allows your team to respond quickly to member inquiries, provide accurate updates, and tailor services based on individual needs.

A smoother financial process enhances trust, strengthens relationships, encourages long-term loyalty, and consistently meets and exceeds your members’ expectations.

Cost Savings Over Time

Investing in updated technology may feel like a significant upfront cost, but it generates substantial savings over time.

Automating tasks such as invoicing, payment tracking, and financial reporting cuts labor costs and minimizes the risk of errors that could lead to penalties, missed payments, or inaccurate reporting.

Statistics show that organizations advancing beyond the initial testing phase of intelligent automation report an average cost savings of 32%, highlighting the long-term financial benefits of automation.

Streamlined processes eliminate the need for multiple tools or third-party services, consolidating expenses into a single, cost-effective solution. Over time, these savings far exceed the initial investment, making finance management software a smart and sustainable choice for growth.

Upgrading Your Finance Management Tools: Where to Start

Evaluate Your Current System

- Analyze the limitations of your existing tools and processes.

- Identify recurring challenges, such as inefficiencies, errors, or lack of features like automation or real-time reporting.

Set Clear Goals

- Define your goals for the upgrade, such as reducing errors, saving time, or improving financial insights.

- Align these goals with your organization’s broader objectives and budget.

Gather Input From Your Team

- Consult with team members who use the current system to understand their pain points and expectations.

- Engage stakeholders to confirm their needs are considered in the upgrade process.

Research Potential Tools

- Explore finance management tools that match your organization’s size, complexity, and future scalability.

- Compare features, pricing, and reviews to shortlist the most suitable options.

Plan Your Implementation Process

- Develop a timeline that includes setup, data migration, and training.

- Assign roles and responsibilities to make certain the upgrade is handled effectively.

Following these steps helps you lay a strong foundation, making the upgrade process efficient and guaranteeing your new tools deliver the desired results.

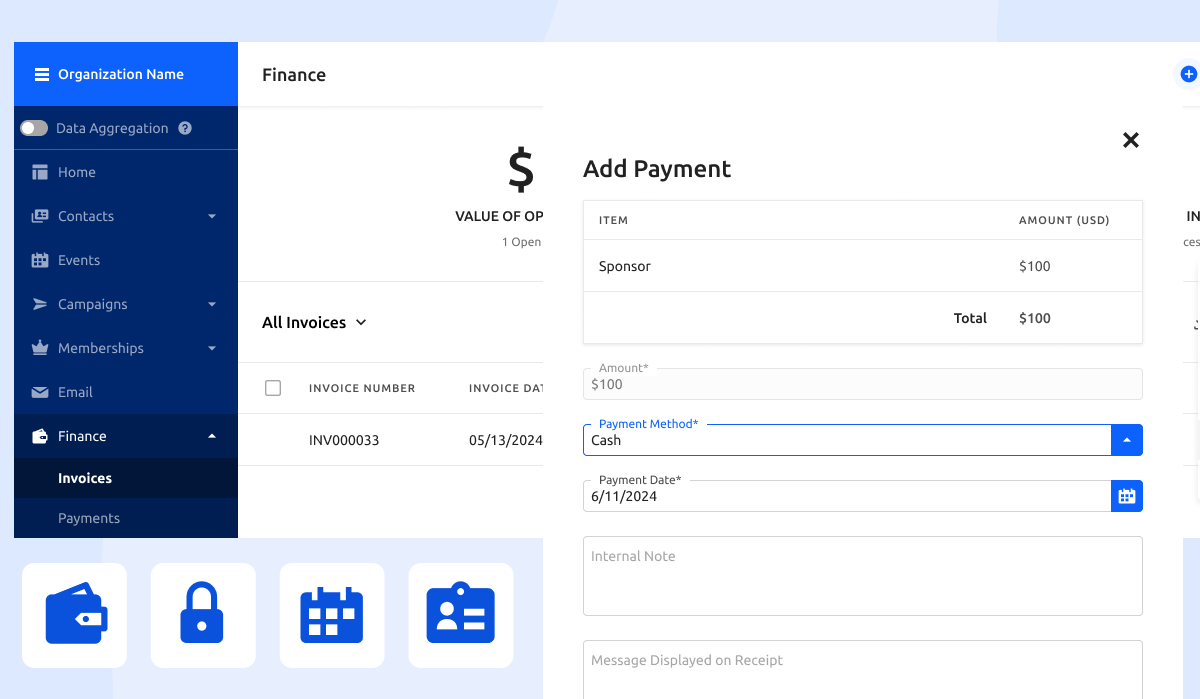

Getting Advanced Finance Tools With Glue Up

Glue Up is an all-in-one finance management software that uses advanced tools and features to help organizations streamline their financial processes.

The solution is designed to simplify and enhance financial management; It provides everything needed to improve efficiency, accuracy, and member satisfaction.

Let’s explore some of its key features:

Automated Invoicing and Custom Reminders

Automated invoicing helps you generate invoices instantly and saves hours of manual work. Whereas custom reminders guarantee timely payment follow-ups, reducing the risk of missed revenue.

Customizable Tax Setup

This feature allows you to configure tax rates specific to your region, making tax management straightforward and guaranteeing compliance.

Multi-Currency Support

You can accept payments in over 100 currencies, enabling seamless transactions for a global audience and removing the hassle of currency conversions.

Local Payment Methods

Offering local payment options, such as bank transfers or credit cards, gives your members flexible payment options, enhancing their payment experience.

Real-Time Analytics and Reporting

Real-time analytics allows you to access up-to-date P&L reports and dashboards from anywhere, allowing you to fully control your financial data at any moment.

Integration With Accounting Software

Seamlessly integrating tools like QuickBooks and Xero lets you synchronize invoices, manage line items, and simplify your financial workflows.

Secure Payment Processing

Advanced security measures safeguard all transactions through SSL encryption, GDPR compliance, and PCI DSS certification.

Mobile Financial Management

Glue Up’s mobile app allows you to manage financial processes on the go, whether accessing reports or reviewing dashboards.

Customizable Dashboards and Easy Export

Tailoring dashboards to suit your needs helps you organize financial data effectively, while easy export options make audits or reviews hassle-free.

These features allow you to automate repetitive tasks, reduce errors, and streamline your financial processes. With advanced tools, you can save time, enhance accuracy, and focus on growing your organization while improving member satisfaction.

Ready to take your financial management to the next level? Book a demo today and see Glue Up in action!

- Challenges with Traditional Financial Processes

- Benefits of Adopting Advanced Financial Tools

- Streamlined Operations

- Reduced Errors and Improved Accuracy

- Enhanced Member Experience

- Cost Savings Over Time

- Upgrading Your Finance Management Tools: Where to Start

- Getting Advanced Finance Tools With Glue Up