The annual financial report serves as the comprehensive yearly overview of the association or business, detailing its journey from the beginning to the end of the year, month by month. It plays a crucial role in assessing the company's performance over the past financial year.

Organizations heavily depend on this report and carefully craft it to gain insights into their financial standing. To navigate the complexities of preparing an annual financial report, this blog provides an elaborative guide.

Probe in to learn how to effectively compile and present this critical document for a thorough understanding of your company's financial performance.

Key Takeaways

- The annual financial statement provides stakeholders with a comprehensive overview, enabling them to assess the company's performance over the past year.

- A well-prepared annual financial report delivers ample data, facilitating effective budget planning, assessing risks, evaluating profitability, and projecting future returns.

- To prepare an annual financial report, it is essential to compile all necessary financial statements, including income statements, balance sheets, cash flow statements, and relevant receipts.

- Publicizing the financial report creates transparency among stakeholders, as this report reveals financial performance, accomplishments, and future plans. It also encourages investors.

What Is an Annual Report?

An annual report thoroughly overviews the association's or business's yearly performance. This report is segmented into month-by-month and week-by-week progress.

It outlines the budget allocation, expenses incurred, profits, losses, and associated ratios, incorporating charts and graphs highlighting peak performance months.

Also, the report indicates sales fluctuations, client retention percentages, and revenue generation, summarizing the company's journey from the year's inception to its conclusion.

By scrutinizing this report, you can effectively assess the performance of the overall business. Furthermore, the annual report aids in forecasting the organization's standing compared to competitors, providing valuable insights for strategic planning and future decision-making.

What Is the Purpose of Financial Reporting?

The primary objective of financial reporting is to deliver business insights. However, these reports go beyond just insights, providing a wealth of detailed information that covers various critical aspects, as follows:

Communicate Essential Data

Financial insights are important in fostering communication with stakeholders, including investors, executives, and other key parties. This information is essential for:

- Effective budget planning

- Assessing risks

- Profitability

- Future returns

According to the EY Global Financial Accounting Advisory Services (FAAS) corporate reporting survey, 72% of respondents stated that finance teams are increasingly expected to measure and communicate how the company creates long-term value for investors and other stakeholders. This underscores the importance of annual reports in delivering the essential data to stakeholders for evaluating a company's long-term value creation.

For instance, if the median gross profit for a B2B business is $76k per month and your financial insights reveal that your business has consistently exceeded this benchmark, it becomes a compelling point to showcase to your investors.

Outperforming industry standards can serve as a powerful incentive to seek additional funding, emphasizing the business's robust performance and potential for further growth. Moreover, publicly disclosing this document enhances transparency, instilling confidence and trust among investors and other stakeholders in your business.

Monitors Income and Expenses

Financial reporting plays a vital role in the systematic monitoring of spending areas, judicious budget allocation, precise profit calculation, and accurate identification of losses.

It serves as an essential tool in pinpointing extra expenses that may need to be trimmed, facilitating efficient debt management, and providing a comprehensive overview of assets. Additionally, financial reporting aids in evaluating the debt-to-asset ratio, offering insights into the financial health and stability of the business.

Importantly, this process allows for proactive calculations, enabling businesses to stay ahead of their competition by anticipating challenges and strategically positioning themselves in the market.

Supports Financial Analysis and Decision-Making

The performance analysis within an annual financial report is instrumental in enhancing decision-making for the business. According to the EY survey, 79% of finance leaders state that they currently have the necessary data volumes to provide stakeholders with the insights they seek into company culture. This report, therefore, aids investors in making informed decisions.

By leveraging diverse data points within the report, you can effectively track

- Real-time performance metrics

- Identify key spending areas

- Spot opportunities or areas of interest

This capability is invaluable for making accurate forecasts.

The detailed financial analysis not only enables businesses to stay ahead of the curve but also empowers them to discern current trends and identify potential revenue-generating aspects.

Compliance

Another reason financial reporting is mandatory is to ensure compliance with legal bodies and government agencies. These entities establish specific criteria and templates that dictate how financial activities must be disclosed.

It allows them to track your financial activities throughout the year with the help of this annual financial report. Adhering to these guidelines is imperative, given the set deadlines for submission.

In the United States, compliance is monitored by the Generally Accepted Accounting Principles (GAAP), while international associations follow the International Financial Reporting Standards (IFRS), reinforcing the necessity to maintain accurate books and prepare reports within the given time frame.

This adherence is particularly crucial for legal businesses to uphold regulatory requirements.

Simplify Your Taxes

Taxes can be a hectic task for businesses, regardless of their size. An accurate annual financial report significantly aids in calculating tax returns; otherwise, the complexity of tax returns can be overwhelming.

Creating a well-detailed financial report is instrumental in simplifying the tax filing process, making it more manageable. This approach not only streamlines the filing of tax returns but also facilitates the Internal Revenue Service (IRS) in accurately assessing taxes.

By adhering to this practice, businesses can establish a positive reputation and avoid potential penalties associated with untimely tax filings, emphasizing the importance of timely and accurate tax reporting.

How to Prepare Your Association's Annual Financial Report: A Step-by-Step Guide

The annual financial report plays a significant role in assessing the company's performance and is a legal requirement. Even a seemingly simple report can become complex to prepare. Therefore, we are providing you with a step-by-step guide on how to prepare this crucial document.

Step 1: Gather and Review Financial Data

The first and foremost step in preparing a detailed financial report is to collect and organize all financial data for the reporting period, including

- Income statements

- Balance sheets

- Cash flow statements

- Relevant Receipts

Subsequently, it is crucial to ensure the accuracy and completeness of the financial data through a comprehensive review of these statements.

Finally, a thorough examination of the financial data is essential to identify any evident trends, patterns, or areas of concern that may necessitate further insightful analysis or explanation.

Step 2: Develop a Membership Forecast

The second step involves developing a membership forecast. To accomplish this, you need to create a detailed spreadsheet where you insert your membership records spanning the year, carefully tracking performance.

This spreadsheet should include different sections, such as members retained, new members acquired, and estimates for membership in the upcoming year. Additionally, incorporate a dedicated section detailing how much revenue was generated from members throughout the year.

Further enhance the analysis by breaking down revenue according to different membership plans, providing insights into the average spending of each member. This strategic approach ensures a subtle understanding of both membership dynamics and financial contributions, contributing to well-informed and precise membership projections.

Step 3: Create a Budget for Expenses

The third step is paramount as it involves decoding the expenses. It is imperative to review historical expense data methodically to identify areas where costs can be controlled or reduced.

This process is instrumental in developing a detailed expense budget for each department or program. The budget should consist of all the details, including the sources of funding, major spending areas, and priorities for each department or program.

Factors such as projected membership, operational needs, and strategic initiatives should be carefully considered during budgeting.

This strategic approach thoroughly examines expenses, facilitating informed decision-making and efficient cost management across various aspects of the organization.

Step 4: Prepare Financial Statements

The fourth step is to generate the income statement, balance sheet, cash flow statement, and statement of changes in equity for the reporting period. It is crucial to ensure that these financial statements are carefully prepared in accordance with Generally Accepted Accounting Principles (GAAP) or other applicable accounting frameworks.

This detailed preparation not only ensures accuracy and compliance but also promotes transparency for investors, partners, and the public.

By providing a clear and precise snapshot of the organization's financial performance and position, these statements contribute to building trust and understanding among stakeholders. According to the "Enhancing Investors Trust Report 2022," 80% of retail investors aged 25–34 expressed trust in the completeness and accuracy of the information, highlighting financial statements' significant role in delivering confidence and informed decision-making.

Step 5: Analyze and Interpret Financial Performance

In the subsequent step, calculate key financial metrics, including but not limited to revenue per member, expense per member, reserves-to-expenses ratio, and debt-to-equity ratio. This involves precisely examining the organization's financial landscape to derive meaningful insights.

Compare these financial metrics to internal historical trends and industry benchmarks, enabling a comprehensive analysis of strengths, weaknesses, and areas for improvement. This strategic assessment provides valuable insights that guide decision-making and enhance the organization's overall financial health.

Step 6: Write the Management Discussion and Analysis (MD&A)

In the sixth step, furnish a narrative overview of the association's financial performance, stressing key trends, significant changes, and factors influencing the results.

This narrative should explore the association's strategic direction, address risks and uncertainties, and outline the future outlook. Providing a comprehensive report ensures a contextual understanding of the financial performance, offering stakeholders a fine-tuned perspective on the association's past, present, and future financial landscape.

Step 7: Prepare the Letter to Members

The seventh step involves preparing personalized letters addressed directly to members. These letters briefly summarize the association's financial performance, accomplishments, and future plans.

Take the opportunity to convey the association's overarching mission, values, and unwavering commitment to its members. The letters deliver a sense of connection and transparency by directly addressing members, ensuring members are well-informed about the association's financial standing and strategic vision.

Step 8: Assemble the Annual Report

Following that, your next task is to create a cover page that prominently features the association's name, logo, and reporting period. Integrate a user-friendly table of contents to facilitate easy navigation throughout the report.

Ensure the inclusion of essential sections such as the letter to members, Management's Discussion and Analysis (MD&A), financial statements, and any other pertinent information. Design the report with a clear and consistent layout, leveraging visuals and graphics strategically to enhance readability.

This diligent approach ensures a professional and organized presentation and contributes to a more engaging and informative annual financial report.

Step 9: Review and Audit the Annual Report

The second last step involves conducting a demanding annual report review, examining it for accuracy, completeness, and compliance with applicable regulations. To ensure additional scrutiny, engage external auditors to review the financial statements independently and provide an audit opinion if required by association bylaws or regulations.

This dual review process not only validates the integrity of the financial information but also reinforces transparency and adherence to regulatory standards, instilling confidence among stakeholders in the reliability of the annual report.

Step 10: Distribute the Annual Report

The final step in the process is to distribute the annual report to members, potential members, stakeholders, and other interested parties.

This distribution ensures that relevant individuals and entities have access to the comprehensive information encapsulated in the annual report, fostering transparency and keeping all concerned parties well-informed about the association's financial performance and strategic outlook.

This step is critical for maintaining open communication, building trust, and promoting a shared understanding of the association's achievements and future plans.

Additional Tips for an Effective Annual Report

You've learned the essential steps, but here are a few additional tips. If you take these into account, your financial report will be clearer, more professional, and easier to understand:

- Use Visuals: Incorporate charts and graphs to present complex data in a more digestible format.

- Keep it Concise: Avoid overloading the report with unnecessary details. Focus on key insights and results.

- Highlight Key Achievements: Emphasize milestones and successes to show progress and impact.

- Provide Context: Explain significant changes in financial performance to help readers understand the "why" behind the numbers.

- Ensure Consistency: Maintain consistent formatting and clear language throughout the report for a polished presentation.

Common Mistakes to Avoid

It's important to include all the necessary information and data in your report, but it's also essential to avoid certain mistakes to prevent inaccuracies.

Here are some common errors to watch out for:

- Incomplete Data: Omitting key data points can make the report inaccurate or misleading.

- Lack of Clarity: Confirm that your data is presented clearly to avoid confusion.

- Overloading with Details: Too much information can overwhelm readers. Focus on key insights.

- Ignoring Visuals: Not using charts or graphs can make the report harder to understand.

- Inconsistent Formatting: Inconsistent styles can make your report look unprofessional.

- Missing Context: Failing to explain key changes or results can lead to misinterpretation.

Taking Benefit from Technology for Reporting

Using technology simplifies reporting by automating data collection and analysis, improving accuracy.

Let's explore the tools you can capitalize on to enhance your reporting process.

Financial Reporting Software

Using specialized financial reporting software can streamline the process of preparing an annual report. These tools help automate the gathering and organization of financial data, reducing errors and saving time.

Financial reporting software also offers features such as customizable templates, real-time data syncing, and compliance checks, making it easier for associations to generate accurate and professional reports.

Data Visualization Tools

Data visualization tools can elevate your financial report presentation by transforming raw data into visually appealing charts and graphs.

These tools allow you to represent complex financial information in a way that is easier to understand and more engaging for readers.

Besides, incorporating interactive visuals helps certify that stakeholders grasp the key financial trends and insights quickly and effectively.

Resources for Further Assistance

For additional support, explore various resources.

Here are some to consider:

Templates and Examples

For associations new to financial reporting, templates offer a structured way to organize data, while sample reports guide formatting. Sharing links to useful templates gives access to necessary tools for creating accurate reports.

Professional Services

Associations may need financial professionals for auditing, complex statements, or compliance. Outsourcing can ease internal pressure and help guarantee reports meet industry standards.

Simplify Preparing Your Annual Financial Report Using Glue Up

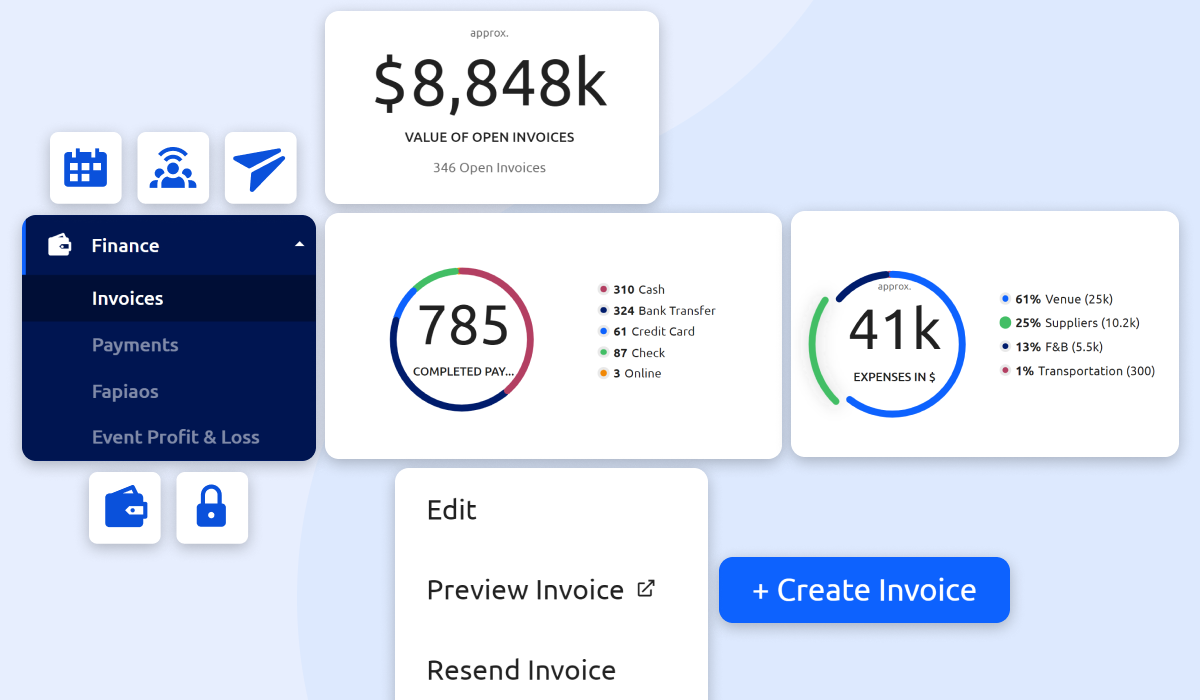

A finance management solution is important for any member-based association or organization to track expenses, revenue, profits, and losses, facilitating the accurate preparation of the annual financial report.

Glue Up, as a comprehensive finance management solution, provides a range of features designed to support efficient financial reporting.

Here’s what Glue Up offers:

Automate All Your Finance Processes

Automating finance processes reduces manual errors and guarantees that all transactions are captured accurately, streamlining the preparation of your annual financial report.

Automatic Invoicing

With automatic invoicing, you can track all billing activities in real-time, making it easier to reconcile income when preparing your annual report.

Customizable Tax Setup

Glue Up allows you to customize tax settings, making certain that all taxes are calculated and applied correctly, simplifying tax reporting during financial audits.

Centralize and Track All Payments

Centralizing payment data helps you maintain a clear record of incoming and outgoing payments, avoiding discrepancies when compiling financial statements.

P&L Reports

Profit and Loss (P&L) reports provide an overview of your financial performance, offering key insights to include in your annual report.

Real-time Analytics

Real-time analytics provide up-to-date insights on financial performance, helping track trends and make more accurate projections for your financial reports.

Customizable Dashboards

Customizable dashboards allow you to monitor critical financial metrics in one place, making it easier to gather the data needed for your annual report.

Easy Export

Easily export financial data into formats compatible with your accounting software, streamlining the process of compiling necessary financial documents.

Integrate Your Favorite Accounting Software

Connecting Glue Up with your preferred accounting software creates a smooth flow of data, reducing manual data entry and minimizing errors in your financial reports.

To learn more about how Glue Up can support your financial reporting, you can book a demo.