Did you know that 70% of businesses that regularly analyze their financial statements report significant improvements in their financial performance and strategic decision-making capabilities? (Corporate Finance Institute) (NetSuite)

Financial statements are vital tools that provide crucial insights into your organization's financial health and performance. If analyzed correctly, they help you make informed decisions, forecast revenue, mitigate risks, and ensure your association's long-term sustainability.

Let's explore seven smart techniques to help you analyze your association's financial statements with confidence and precision.

Key Takeaways

- Analyze each financial statement for unique insights. The balance sheet shows the financial position, the income statement reveals operational efficiency and the cash flow statement highlights cash movement.

- Use financial ratios to quickly assess health and identify trends. Focus on liquidity ratios like current ratio and quick ratio, as well as solvency ratios like debt-to-net assets ratio.

- Examine long-term fiscal trends in revenue, expenses, and asset growth. This helps spot emerging patterns and allows for proactive management adjustments.

- Address budget variances by understanding their causes and impacts. Use this knowledge to improve future budgeting and financial management processes.

- Utilize association management software to streamline financial analysis. This technology reduces errors, saves time, and provides deeper insights into overall organizational performance.

1. Understand the Purpose of Each Financial Statement

Before performing an analysis, it's essential to understand the purpose of each financial statement:

Balance Sheet

A balance sheet captures your association's financial position at a specific moment in time.

It lists everything your organization owns (assets) and owes (liabilities), answering the critical question: "Does the association have enough assets to cover its liabilities?"

Tips for Analyzing Balance Sheet

When analyzing your balance sheet, pay close attention to the relationship between your current assets and current liabilities. This comparison, known as your working capital, indicates your association's short-term financial health.

A positive working capital suggests you can meet immediate obligations, while a negative figure may signal potential cash flow issues. Additionally, examine trends in your net assets (the difference between total assets and total liabilities) over time to gauge your association's overall financial strength and growth.

Income Statement

Also known as a Statement of Activities in the non-profit sector, this document highlights your association's operating environment. It answers questions like, "Are we efficient in our operations?" and "What do our margins look like?"

How to Analyze Income Statements?

- Analyze the diversity and stability of your revenue streams, looking for opportunities to strengthen or expand them.

- On the expense side, evaluate your program efficiency by comparing program expenses to total expenses. This ratio can help you determine if you're allocating resources effectively toward your mission.

- Pay attention to your operating margin (net income divided by total revenue) as it indicates your association's overall financial efficiency and ability to generate surplus funds for future growth or unexpected challenges.

Cash Flow Statement

This statement showcases the flow of cash in and out of your association, highlighting how cash is generated and used across various activities.

Tips for Effectively Analyzing Cash Flow Statements

Understanding your cash flow statement's quality requires you to look beyond its bottom line.

Examine the cash generated from operating activities, as this represents the sustainability of your core operations. A consistently positive operating cash flow is a good sign, while negative flows may indicate potential issues with collecting receivables or managing expenses.

Also, pay attention to cash flows from investing and financing activities. These can provide insights into your association's long-term strategies, such as expanding programs (investing) or managing debt (financing).

Remember, profitability doesn't always equate to good cash flow, so this statement is crucial for understanding your true liquidity position.

2. Assess Key Financial Ratios

Key financial ratios help you distill complex financial data into simple, comparable metrics. They allow you to quickly assess your association's financial health, identify trends, and benchmark against industry standards or your historical performance.

Here are the essential ratios to focus on:

Liquidity Ratios

These ratios measure your association's ability to meet short-term obligations and handle unexpected financial challenges. There are two types of liquidity ratios, mainly:

a. Current Ratio

You can calculate the current ratio by dividing your current assets by your current liabilities.

Aim for a ratio between 1.5 and 3, which indicates your association has sufficient short-term assets to cover near-term obligations. A ratio below 1.5 might signal potential cash flow issues, while a ratio above 3 could suggest inefficient use of assets.

Consider strategies to improve this ratio if it falls outside the ideal range, such as accelerating receivables collection or negotiating better payment terms with creditors.

b. Quick Ratio

Also known as the "acid test ratio," this is a more stringent measure of liquidity. Subtract inventory from current assets, then divide by current liabilities. A ratio of 1 or higher is generally considered good, indicating your organization can meet short-term obligations without relying on inventory sales.

If your quick ratio is consistently below 1, you may need to reassess your short-term financial strategy, perhaps by building up more liquid assets or reducing current liabilities.

Solvency Ratio

The solvency ratio helps you assess your association's long-term financial stability and ability to meet long-term obligations. It mainly consists of the debt-to-net assets ratio.

Debt-to-Net Assets Ratio

Compute this by dividing total liabilities by total unrestricted net assets. A ratio under 2 typically indicates a solid foundation of unrestricted net assets, suggesting financial stability. However, a higher ratio may indicate an over-reliance on borrowed funds, potentially putting your association at risk if economic conditions worsen.

If your ratio is high, consider developing a plan to gradually reduce debt or increase unrestricted net assets. Remember, though, that some debt can be beneficial for growth, so balance is key.

After calculating these ratios, compare them to industry benchmarks and your association's historical performance. Identify any deviations and develop strategies to address areas of concern.

Note that while these ratios provide valuable insights, they should not be viewed in isolation. Consider the broader context of your association's goals, industry trends, and economic conditions when interpreting these metrics. It is also important to understand that every industry or type of association may have its own "healthy" ranges for these ratios, so always contextualize your analysis within your particular industry.

3. Map Long-Term Fiscal Trends

The long-term financial analysis provides valuable context about the evolving financial situation of your association and helps you spot emerging patterns that might not be apparent in a single year's data.

Look for notable trends or patterns in:

Revenue Streams and Growth

Analyze how your various income sources have changed over time. Are certain revenue streams growing consistently while others decline?

This can help you identify which programs or services are most financially viable and where you might need to focus more attention.

Expense Trends and Cost Management

Look for patterns in your expenses. Are certain costs rising faster than inflation or your revenue growth? This could signal areas where you need to implement better cost controls or seek more efficient alternatives.

Assets Growth

Examine how your association's assets have changed over time, including both tangible resources (e.g., property, equipment) and monetary resources (e.g., investments, cash reserves).

A steady increase in assets generally indicates financial strength, while stagnation or decline might suggest underlying issues.

Long-term fiscal trends help you gain foresight into potential issues or opportunities, allowing you to adjust your management practices accordingly. For instance, if you notice a consistent decline in a particular revenue stream over several years, you might decide to revamp the associated program or phase it out in favor of more promising initiatives.

Remember, while identifying trends is important, understanding the reasons behind them is equally crucial. For each significant trend you identify, ask yourself and your team:

- What's driving this trend?

- Is this trend likely to continue, reverse, or stabilize?

- How does this trend align with or challenge our association's strategic goals?

- What actions should we take in response to this trend?

4. Tackle Budget Variances Head-On

Budget variances occur when actual financial results deviate from planned figures. Identifying and addressing these variances is essential for effective financial management.

Most of the budget variances are inevitable, but how you address them can significantly impact your association's financial health.

Strategies for Managing Variances

When addressing variances, it's important to dig deeper than just the numbers. For each significant variance, ask:

- What caused this variance? Was it due to internal factors (like changes in operations) or external factors (like economic shifts)?

- Is this a one-time occurrence or part of a trend?

- How does this variance impact our overall financial health and ability to meet our mission?

- What steps can we take to prevent similar variances in the future, if they're unfavorable?

Look for patterns in these variances and adjust future budgets accordingly. For instance, if you consistently over-allocate funds to a specific program, consider reallocating the surplus to other initiatives in future budgets.

Conversely, if you're routinely underestimating costs in certain areas, it may be time to reassess your budgeting process for those line items.

Remember, the goal isn't to eliminate all variances - that's virtually impossible. Instead, aim to understand them, learn from them, and use that knowledge to improve your budgeting and financial management processes over time.

5. Optimize Cash Flow Management

Given that 82% of businesses fail due to poor cash flow management or a lack of understanding of cash flow itself (ForwardAI), a thorough analysis of your association's cash flows is imperative for evaluating the impact of strategic decisions on financial health.

Review your cash flow statement, typically broken down into three categories:

- Operating activities: Day-to-day income and expenses

- Investments: Long-term asset purchases and sales

- Financing: Loans, grants, and other funding sources

A thorough cash flow analysis allows associations to make informed strategic decisions. Once you get a detailed report, consider the following steps to enhance your cash flow management:

- Conduct regular cash flow forecasts to anticipate potential shortfalls or surpluses

- Implement strategies to accelerate receivables and optimize payable timing

- Explore opportunities to diversify revenue streams and reduce reliance on a single income source

- Evaluate the ROI of major expenses and investments to ensure they contribute to your association's mission

- Implement Robust Financial Review Protocols

6. Implement Frequent Review Processes

Keeping an eye on your association's financial statements is imperative for detecting any discrepancies that might go unnoticed. They also help in identifying the developing trends and improving the budgeting.

To establish a culture of financial vigilance, consider implementing the following practices:

- Schedule frequent reviews: Aim for monthly or bi-monthly financial statement reviews to standardize your analysis process and maintain a pulse on your association's fiscal health.

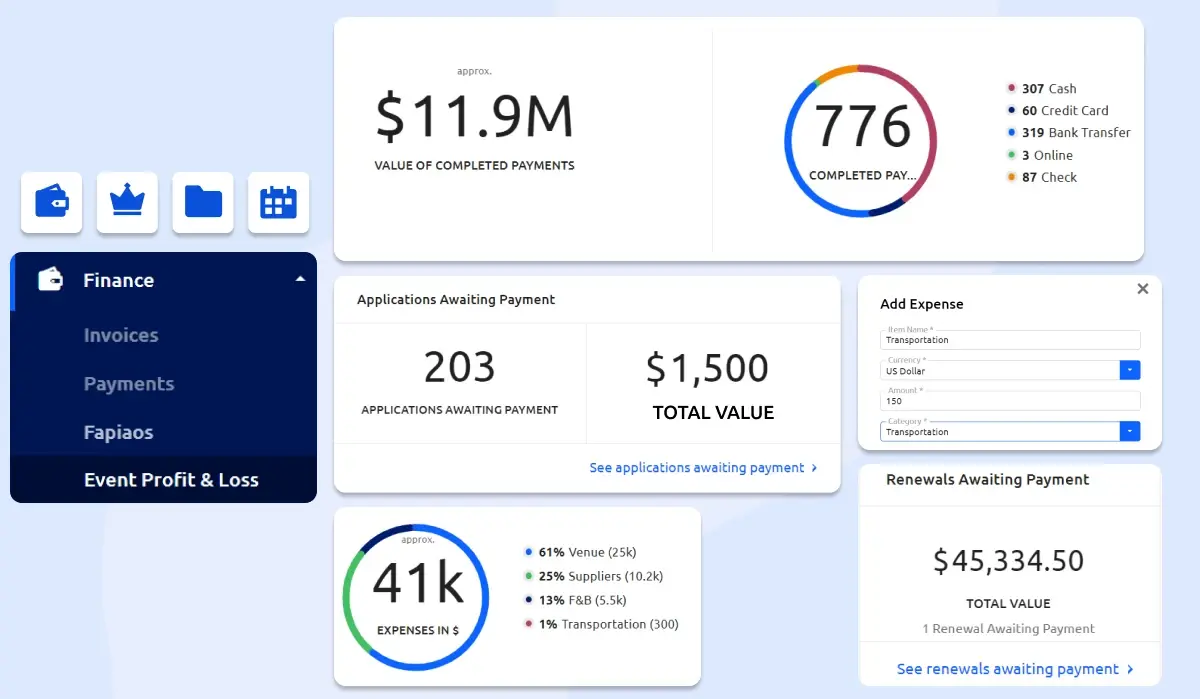

- Leverage technology: Utilize financial management software and dashboards to streamline data analysis and provide real-time insights into key performance indicators (KPIs).

- Engage cross-functional expertise: Involve your financial committee, department heads, and external advisors in the review process to ensure a comprehensive evaluation and diverse perspectives.

- Educate leadership and stakeholders: Provide your board members and key stakeholders with clear, concise financial reports and explanations. Consider offering financial literacy training to enhance their ability to interpret and act on financial information.

- Develop action-oriented reporting: Create reports that not only present data but also include actionable insights and recommendations for improvement.

- Benchmark performance: Compare your association's financial metrics against industry standards and peer organizations to identify areas for improvement and best practices.

7. Consolidate Financial Data with Technology

Leveraging technology can significantly enhance your ability to analyze financial statements efficiently and accurately. In fact, a survey by Microsoft found that 79% of finance leaders believe they must play a significant role in business innovation to meet future needs (The Official Microsoft Blog).

You can find different types of software in the market; however, we recommend using consolidated association management software. This is because tracking finances with an all-in-one software like Glue Up offers several benefits for financial analysis such as:

- Reduce manual data entry errors and save time by automatically pulling financial data from various sources into a centralized system.

- Access up-to-date financial information at any time, allowing for more timely decision-making.

- Create visual representations of key financial metrics and ratios for easy monitoring and analysis.

- Seamlessly connect your financial data with other association management functions for a more comprehensive view of your organization's performance.

Thus, by utilizing association management software, you can streamline your financial analysis process, improve accuracy, and gain deeper insights into your association's financial health.

If you'd like to learn more about financial statements and how you can analyze them using technology - download our comprehensive guide to financial planning and budgeting or feel free to get a personalized demo here.

We wish you success in improving your financial health and accelerating your association's growth!