Where should associations go when choosing between payment gateways and processors? This decision has become tricky and challenging, especially since both play essential roles in handling online payments.

Many businesses struggle to understand which one they need, leading to unnecessary confusion and inefficiencies. The wrong choice might result in higher transaction costs, slower processing times, or even security risks that could affect members' trust.

This blog explains the differences between payment gateways and processors, helping you choose the best solution for your organization. If your focus is on smooth transactions or security, this guide will help you make the right decision for your payment system.

Key Takeaways

- Gateways secure and transmit payment data; processors handle the transaction between banks.

- Both systems ensure secure transactions and protect sensitive data.

- SMEs often use all-in-one solutions, while larger organizations may need separate gateways and processors for more control.

- Migrating between payment systems can improve efficiency and security but requires careful planning.

- Glue Up integrates various payment solutions and offers comprehensive management features. Book a demo to see how it can benefit your organization.

What is a Payment Gateway?

Let's start by comparing the payment gateway vs. payment processor with the payment gateway first. A payment gateway is a secure platform that handles the transfer of payment data between your members and your organization.

In member organizations, the payment gateway facilitates payments for things like membership dues, event fees, and donations. It makes sure that sensitive information, such as credit or debit card details, is encrypted and securely transferred from your website or platform to the payment processor.

The main role of the payment gateway is to act as a middleman between the member's payment method and your organization's bank, guaranteeing that transactions are fast and secure.

According to reports, the global payment gateway market is projected to reach USD 161.0 billion by 2032, highlighting the increasing importance and demand for secure payment solutions.

The absence of a payment gateway would make online transactions much more vulnerable to breaches, putting both your members and your organization at risk. Implementing the right payment gateway can streamline the payment process while providing an extra layer of protection.

With 82% of Americans using online payments, having a secure gateway is vital for maintaining trust and facilitating smooth transactions. This is why payment gateways are essential and increasingly inevitable.

Top-Ranked List of Payment Gateways

Choosing the right payment gateway is a must for certifying smooth and secure transactions for your member organization. Here are some top-ranked payment gateways to consider:

- PayPal: One of the most widely used gateways, PayPal holds 45% of the global payments market share and offers secure payment processing with a user-friendly interface. It supports a wide range of payment methods and currencies, making it an ideal choice for global member organizations.

- Stripe: Stripe has a market share of about 21%, making it the world's second-most used payment solution. It is known for its seamless integration with online platforms and advanced features like subscription management and recurring payments, which are perfect for organizations with membership-based models.

- Authorize.Net: A trusted name in payment processing, Authorize.Net provides robust security features and is popular among small to medium-sized organizations. It also supports recurring billing, making it ideal for memberships.

- Square: Square is a versatile payment gateway that not only handles online payments but also offers point-of-sale solutions for in-person transactions, which is helpful for events or conferences.

- Braintree: A subsidiary of PayPal, Braintree offers advanced features like support for multiple currencies, customizable checkout experiences, and top-notch security, making it a solid choice for growing organizations.

Each of these gateways offers unique features to meet different organizational needs. However, integrating them into your system requires a robust association management solution like Glue Up.

Glue Up lets you integrate most payment gateways and gives your members the flexibility to use their preferred payment method. Book a demo to learn more about how it works.

Additionally, when selecting the best gateway for your members, consider your organization’s size, the types of payments you process, and the level of integration required.

What is a Payment Processor?

A payment processor is a service that handles the transaction between your member’s bank or credit card issuer and your organization’s bank.

However, the payment gateway securely transmits the payment information, and the processor takes care of the actual transaction, making sure that funds are transferred from the member’s account to your organization’s account.

The payment processor plays a crucial role in verifying payment details, approving or declining the transaction, and managing the flow of funds behind the scenes. Payment processors work closely with banks and card networks to establish that payments are completed quickly and securely.

For member organizations, a reliable payment processor ensures that every membership fee, donation, or event payment is handled efficiently and accurately.

Top Payment Processors

Choosing the right payment processor is key to ensuring smooth and secure transactions. Here are some top-ranked payment processors:

- Stripe: Known for its flexibility, Stripe handles everything from one-time payments to recurring membership fees, making it ideal for organizations with subscription-based models.

- PayPal Payments Pro: This processor offers advanced features for organizations that want full control over their payment system. It allows for customizable payment processing and integration with membership platforms.

- Square Payments: Square is great for organizations that host events or conduct in-person transactions. It offers robust support for both online and offline payments.

- Adyen: Known for supporting a wide range of payment methods and currencies, Adyen is an excellent option for organizations with a global membership base.

Each of these payment processors has unique features suited to different organizational needs. When choosing the right one, consider factors like pricing, ease of integration, and the types of payments your organization handles.

Payment Processor vs. Payment Gateway vs. Payment Service Provider (PSP)

Here are the key differences between these three services:

Payment Processor

Handles the transaction between your member's bank and your organization's bank. It ensures payments are approved, checks for fraud, and transfers the funds.

Payment Gateway

This secures and transmits payment information from the member to the payment processor, encrypts sensitive data, and initiates the transaction.

Payment Service Provider (PSP)

This type of service combines the payment gateway and processor functions. PSPs like Stripe or PayPal offer a complete solution for processing payments, including security and additional features like fraud detection and payment analytics.

Key Differences

- Role: Processors handle transactions; gateways secure data; PSPs do both.

- Integration: Gateways often need a separate processor; PSPs include both.

- Scope: PSPs offer extra services beyond basic processing and gateway functions.

Understanding these roles helps you choose the best solution for managing payments in your organization.

Why Payment Processors and Gateways Are Essential

Both payment processors and payment gateways are essential for a number of reasons, such as:

Security

Gateways encrypt payment data to protect against fraud, while processors verify and authorize transactions to facilitate secure fund transfers.

Data privacy and cybersecurity have become the top concerns, with 48% of responses indicating heightened worries about protecting digital information. This emphasizes the need for strong security measures in payment systems, and both gateways and processors help provide this security while minimizing risk.

Efficiency

Gateways initiate transactions smoothly; processors handle the actual transfer of funds, making payments faster and reducing errors.

Fraud Prevention

Both systems help detect and prevent fraud, protecting your organization and members.

Member Convenience

They certify a quick, easy, and secure payment experience, increasing satisfaction and reducing abandoned transactions.

Global Flexibility

They support various currencies and payment methods, allowing your organization to serve a global audience.

Automating Recurring Payments

Payment processors and gateways automate fees and renewals, allowing members to set up automatic payments and reducing manual intervention.

Reducing Administrative Overhead

Automating invoicing and payment collection reduces manual tasks and errors, allowing your team to focus on member engagement.

Improving Cash Flow

Automated payments ensure efficient transfers and predictable cash flow, aiding in better financial planning.

Offering Flexible Payment Options

Support for various payment methods (credit, debit, ACH, digital wallets) increases member convenience and retention.

Ensuring Compliance

Payment systems handle sensitive data securely, ensuring compliance with standards like PCI DSS and protecting your organization from legal issues.

Simplifying Fee Adjustments and Tracking

Easily adjust fees and track payments, gaining insights into financial performance and facilitating accurate reporting.

Choosing the Right Solution: Payment Gateway or Payment Processor?

When deciding between a payment gateway and a payment processor, it’s essential to understand their roles. A payment gateway acts as the secure bridge between your member’s payment method and your organization, encrypting and transmitting sensitive data.

A payment processor, on the other hand, handles the actual transfer of funds, verifying and authorizing transactions to secure smooth payment completion.

Small to Medium-Sized Enterprises (SMEs) often use an all-in-one solution, such as a payment service provider like Stripe or PayPal, which combines gateway and processor functions.

This is ideal for organizations that want simplicity, as these integrated systems reduce the need for multiple vendors and offer features like recurring payments, which are essential for membership-based models.

Larger organizations and businesses, however, may use separate payment gateways and processors. They often require more flexibility, higher transaction volumes, and enhanced security.

In addition, using a dedicated gateway alongside a processor, large associations can tailor their payment system to meet specific needs such as advanced fraud protection, multi-currency support, and customized payment flows.

The right choice depends on your organization's needs. For SMEs, an all-in-one solution is often more efficient, while larger organizations might benefit from using both a gateway and a processor for greater control and customization.

When making your decision, consider factors like the size of your organization, the volume of transactions, and the level of security.

How to Migrate Between Payment Processors and Payment Gateways

If you are not satisfied with your payment gateway or payment processor and want to migrate, there's a way to do so.

However, migrating payment processors or gateways can be complex but necessary to improve efficiency, reduce costs, or improve member experiences. Proper planning is key to minimizing disruptions and ensuring a smooth transition.

Migration is often recommended for reasons like better pricing, enhanced security, or improved support. Careful preparation helps avoid issues like lost payments, technical glitches, or compliance problems.

Steps for Conducting a Payment Processor or Payment Gateway Migration

- Evaluate Your Needs and Set Goals: Assess your reasons for migration, such as lower fees or improved security. Set clear goals, such as minimizing downtime and enhancing member experience.

- Choose the Right Provider: Research and compare providers based on cost, integration ease, and features. Verify compatibility with your organization’s needs.

- Communicate with Members: Inform members about the change, its impact, and any required actions, such as updating payment details. Clear communication helps maintain trust.

- Coordinate with Both Providers: Work with both current and new providers to manage data transfer and confirm technical integration. Align on timelines and security measures.

- Secure Payment Data: Transfer payment data securely and in compliance with PCI DSS standards. Protect sensitive information with encryption and tokenization.

- Test the New System: Test transactions to authorize functionality. Verify that integration with your platform works and that members can make payments smoothly.

- Monitor and Support: After migration, monitor transactions for issues and provide support for any problems. Secure a smooth experience for members with a responsive support team.

- Review and Optimize: Evaluate the migration process, gather feedback, and make improvements as needed to enhance payment efficiency and member satisfaction.

Choose and Integrate Any Payment Solution with Glue Up

Opting for a payment gateway, a payment processor, or both requires a powerful and efficient association management solution.

Glue Up is the first globally AI-powered AMS designed to simplify and enhance your association management experience.

Let’s explore its features:

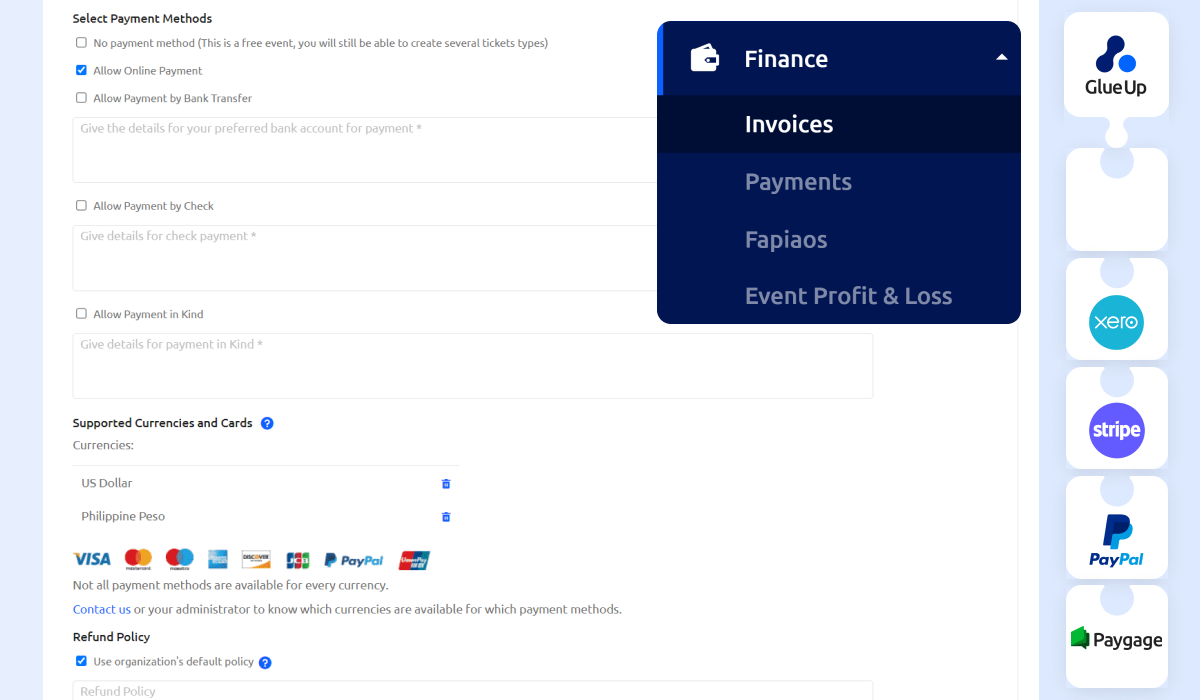

Payment Integration

Seamlessly integrate a variety of payment solutions, including PayPal, Stripe, Braintree, and Flute, for smooth payment processing.

Member Management

Manage member renewals, engagement, and communications from a centralized system.

Finance Management

Handle invoicing, payments, and financial reporting with built-in tools for efficient financial oversight.

Analytics

Gain insights into payments, event attendance, and survey analytics to refine your strategy.

Events Management

Organize and manage events, from registration to attendee engagement, all in one platform.

CRM and Email Campaigns

Connect with members through targeted email campaigns supported by advanced CRM features.

AI Copilot

Utilize the AI-powered writing assistant to draft email campaigns, event descriptions, and survey details, saving time and boosting productivity.

Glue Up allows you to integrate your preferred payment solutions while offering comprehensive association management features. Book a demo to discover how Glue Up can benefit your organization.